Sign up to our newsletter

Research by Social Housing has discovered that in the past year there has been a considerable increase in deal activity occurrence and size within the housing sector. An interesting 12-months of continuous funding increases has resulted in a 70% rise in the total value of housing deals compared to that seen within the two previous years combined. The total deal value was formed from just 51 deals, which were all undertaken within the same one-year period. An additional notable change was that the average deal size has increased from £96.9 million in the period 2015/17 to £143.3 million in 2018 – a prominent 48% increase.

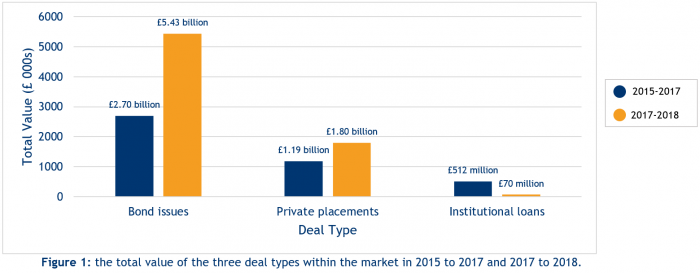

Figure 1 displays the role that each deal type has played in the market changes seen within the past year. Bonds made the largest contribution to the overall increase in deal activity and size, by rising in value by 204% to £5.43 billion. Private placements also contributed to the deal increases through a 51% increase to £1.8 billion. Despite these notable market changes, institutional loans were the only deal type to fall in total value in the same period. The decrease, visible in Figure 1, shows that the value of these bonds reduced from £512 million to £70 million. Regardless of this reduction, the overall value of market activity increased by 70% because bond issues represented over half of the total number of market deals and as a result, this deal type contributed a larger proportion to total market value, hence the market changes seen within the past year.

The increase in market activity can initially appear as an unpredictable market change, however some have viewed this as a product of the 2015 1% rent reduction. Following the emergence of the rent cuts, some providers responded by rewriting business plans and attempting to improve financial efficiency by postponing market activities to a time when it appeared there was greater financial certainty, hence deals which should have been filed in 2016, didn’t go through until 2017.

The increase in market activity can initially appear as an unpredictable market change, however some have viewed this as a product of the 2015 1% rent reduction. Following the emergence of the rent cuts, some providers responded by rewriting business plans and attempting to improve financial efficiency by postponing market activities to a time when it appeared there was greater financial certainty, hence deals which should have been filed in 2016, didn’t go through until 2017.

Housing Associations appetite for funding has notably increased from the data collected by Social Housing, and some suggest this could be linked to the uncertainty that surrounds Brexit. As a result, some could view these market changes as a way in which firms may be preparing for the possibility of restricted funding activity in light of political changes.

A series of financial restructures, mergers and policy announcements have all contributed to the recent surge in market activity, and despite suggestions that Brexit uncertainty may have also made a contribution, there is no doubt that the increase in financial activity is a positive change for the sector. Some have suggested that it demonstrates greater confidence in the housing market and is therefore a positive position for the sector to be moving towards.

Utilising our in-house consultants, as well as a pool of experienced associate consultants, we specialise in a range of housing consultancy services. If you would like to discuss any of the services we offer, please contact Jenny Neville.

.webp?width=600&height=150&name=Pennington%20Choices%20Logo%20(reduced).webp)