Sign up to our newsletter

Pennington Choices has conducted a review of the Regulatory Judgements and Notices released by the Regulator of Social Housing (RSH) from over the past 12 months, in order to help providers to avoid future regulatory scrutiny and ultimately governance or financial viability downgrades. Our analysis used the regulator’s data from the past 12 months on the current and previous regulatory judgements, and after analysing the publications from across this time period, we have identified some common regulatory issues that have arisen within the sector.

The regulator publishes a list of regulatory judgements and notices as a way of providing their official view of each provider. The published position of each provider is categorised under one of the following categories:

- Gradings under review – this rating outlines a warning that the provider is at risk of being in a position of non-compliance and that the Regulator is conducting an investigation.

- Strapline Regulatory Judgement – these judgements state the governance and financial viability rating of an organisation when their overall rating has not changed since their last judgement.

- Narrative Regulatory Judgement – these judgements set out a detailed explanation to the reasons for the Regulator’s assessment. They are published when the regulator’s view of a provider has changed based on an important issue or concern.

- Interim Regulatory Judgement – these judgements are only issued when two providers merge and the combined entity is assessed and provided with a single regulatory judgement.

- Regulatory Notices – there are two types of regulatory notices. Firstly, they can be published when there is evidence that a provider with less than 1000 units is not compliant with the economic standard (in some cases they may also publish a notice for larger providers). Alternatively, these can be published when any provider has breached the consumer standard and there is actual or potential serious harm to tenants.

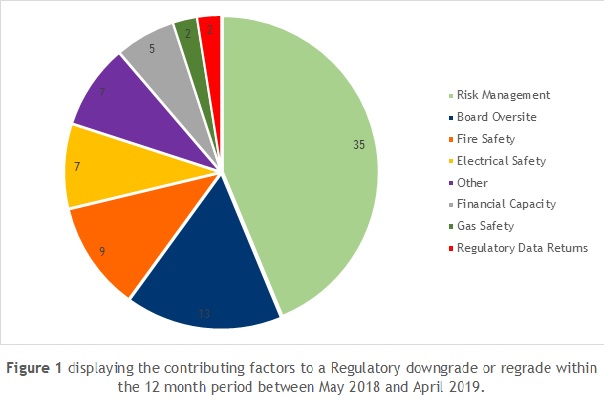

From our analysis of how providers have met the Regulators standards over the past 12 months, we’ve identified some significant findings in relation to the causes of both regrades and downgrades. Firstly, we identified that in 44% of the cases where a regulatory judgement resulted in a change in governance or viability rating, risk management was a primary factor (see figure one). From interpreting the narrative regulatory judgements, we found that in many cases the organisation’s rating had changed as a result of an improvement to, or weakness in, the organisations management of financial risk. For example many organisations lacked the necessary Board and Director level awareness and understanding of the risks that exist within the regulatory environment in which they operate. Other narrative judgements noted that due to the large and diverse nature of some development programmes, providers faced exposure to a range of material and sales risk, which required additional controls and mitigations to be implemented. In many cases, there was a current or previous issue with the application of these controls.

The second most prevalent issue that caused a change to a providers judgement, was a lack of, or an improvement to, the Board’s oversite of compliance. This is often related to insufficient governance arrangements to support continued compliance. The primary factors that lead to a judgement change of this kind, related to a lack of appropriate reporting of health and safety to Board, as well as limited Board involvement in key decision making processes such as stock disposal.

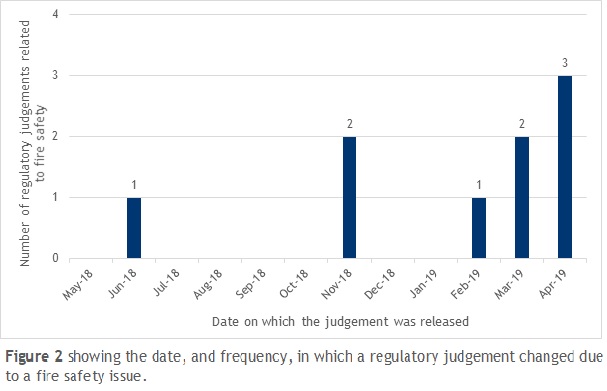

In relation to the ‘big five’ areas of compliance (electrical safety, fire safety, water hygiene, asbestos and gas safety), fire safety was a contributing factor within the largest number of regulatory downgrades/regrades. 15% of published cases, where a regulatory judgement had changed, were related to a fire safety concern. Cases included a failure to regularly review FRAs, a lack of assurance that correct risks had been identified and that the relevant actions to correct the risks had taken place. As shown in figure two, in 8 out of the 9 circumstances where fire safety was listed as a contributing factor in a downgrade/regrade, the judgement took place in the latter 6 months of the 12 month period assessed in this review (between November 2018 and April 2019). This demonstrates that fire safety has played a greater regulatory role in recent months, than the previous 6 months. It could be suggested that this is in line with the Grenfell fire tragedy, which motivated Boards and Chief Executives to order a detailed review of fire safety. The discovery of several fire safety failures from this procedure is likely to have emerged during this time period, hence the significant increase in fire safety related downgrades/regrades over the past 6 months.

Our review also demonstrated that there are significantly more regulatory judgements in relation to a change in governance grading compared to one in financial viability, as shown in Figure 3. As a result, we could conclude that governance is overlooked as a focus for providers. According to the Regulator, ‘effective governance arrangements should deliver a registered providers aims, objectives and intended outcomes for tenants and potential tenants in an effective, transparent and accountable manner’. A providers compliance with the Value for Money standard is also published within the governance judgement. Since the VfM standard was only introduced in April 2018, it is expected that many governance ratings will change as providers adapt to the additional requirements placed upon them, therefore the recent introduction of this standard may explain the larger number of governance grading changes.

Our independent review of the Regulatory Judgements published over the past 12 months highlights some interesting findings about the sectors governance arrangements. Providers should be aware that governance is an area of concern for the sector, and having worked for over 100 organisations within the housing sector, we frequently find that poor governance arrangements come hand in hand with a weak compliance position. Our specialist housing consultants can provide Board training to ensure the Board knows what it needs to know and learns how to overcome the most common property compliance pitfalls through robust governance and strong effective leadership. Contact one of our consultants now by email to find out how we can help your organisation to avoid regulatory downgrade and remain compliant with the Regulators standards.

.webp?width=600&height=150&name=Pennington%20Choices%20Logo%20(reduced).webp)